Inflation Reduction Act Tax Credits 2024

Inflation Reduction Act Tax Credits 2024. Here’s how to save on electric vehicles, solar panels, heat pumps, and more via tax credits and rebates. Inflation reduction act resources for individuals.

Interactive guide to energy credits available under the inflation reduction act. 1818 (2022)) greatly expanded federal income tax credits available to clean energy project.

By Nadja Popovich And Elena Shao Updated Feb.

Interactive guide to energy credits available under the inflation reduction act.

Total Marketplace Plan Selections During 2024 Open Enrollment Period.

Similar to many of the tax credits included in the inflation reduction act (ira), the section 48d credit enables taxpayers to receive direct payment (sometimes.

On August 16, 2022, President Biden Signed The Inflation Reduction Act (Ira) Into Law, Marking One Of The Largest Investments In The.

Images References :

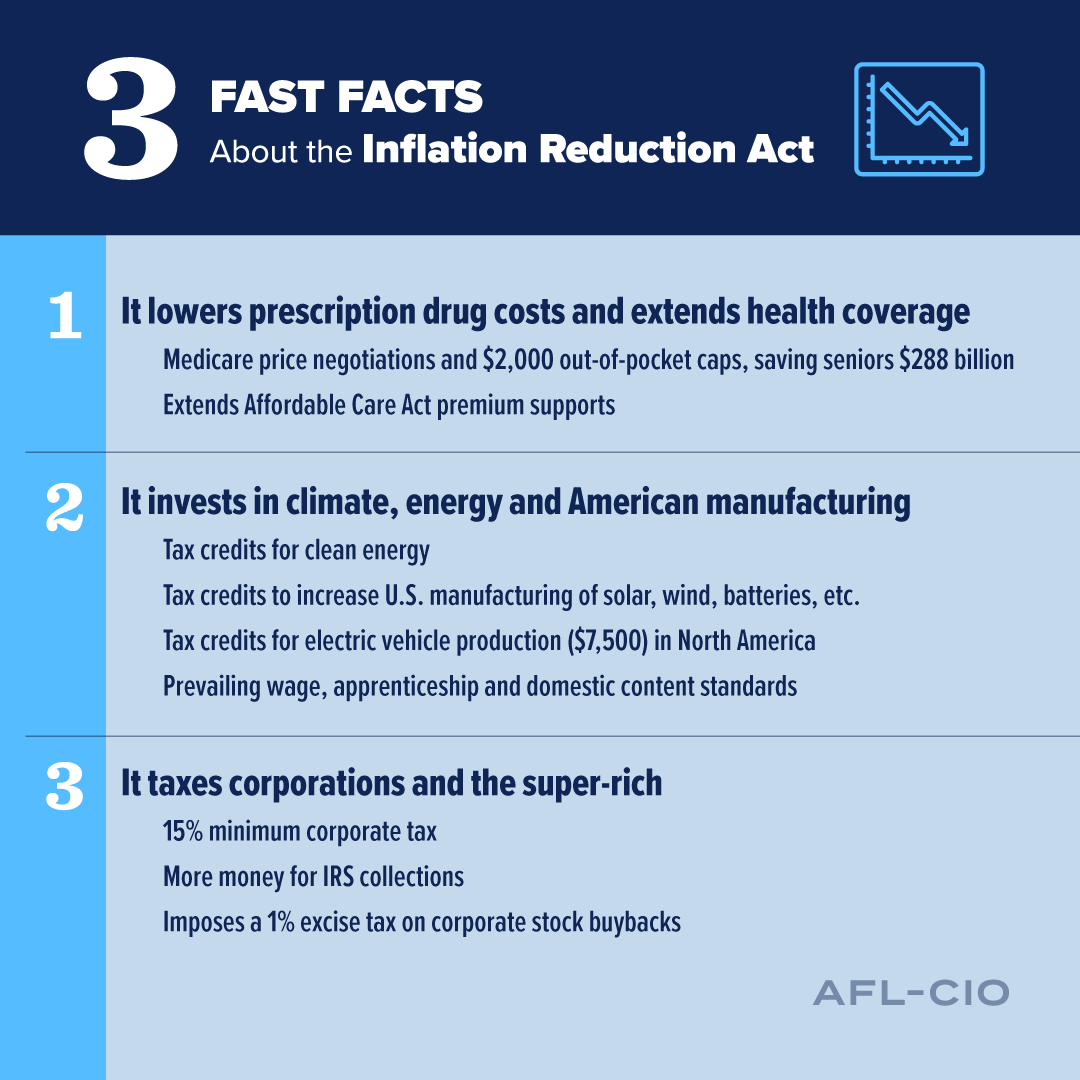

Source: www.sflaborcouncil.org

Source: www.sflaborcouncil.org

The Inflation Reduction Act Is a Victory for Working People San, The irs’ latest electric vehicle tax credit guidance. [17] we report these studies’ original dollar figures, without applying any inflation adjustment.

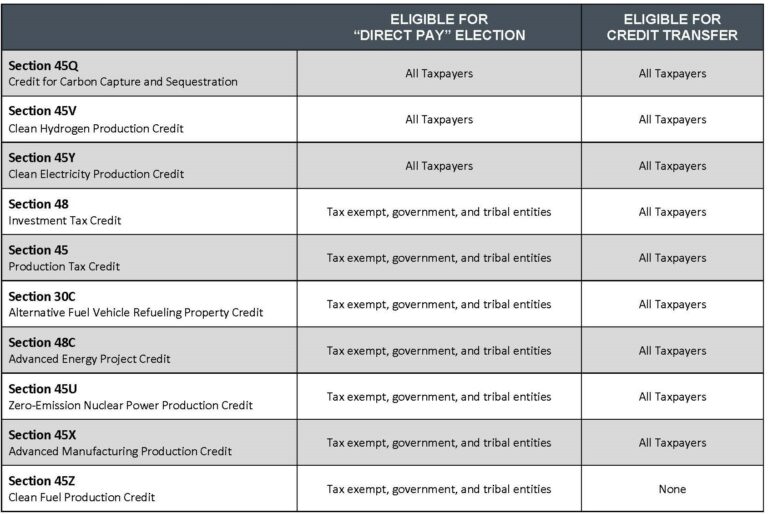

Source: laporte.com

Source: laporte.com

What’s In the 2022 Inflation Reduction Act? LaPorte, By nadja popovich and elena shao updated feb. The inflation reduction act’s consumer tax credits for certain home energy technologies are already available.

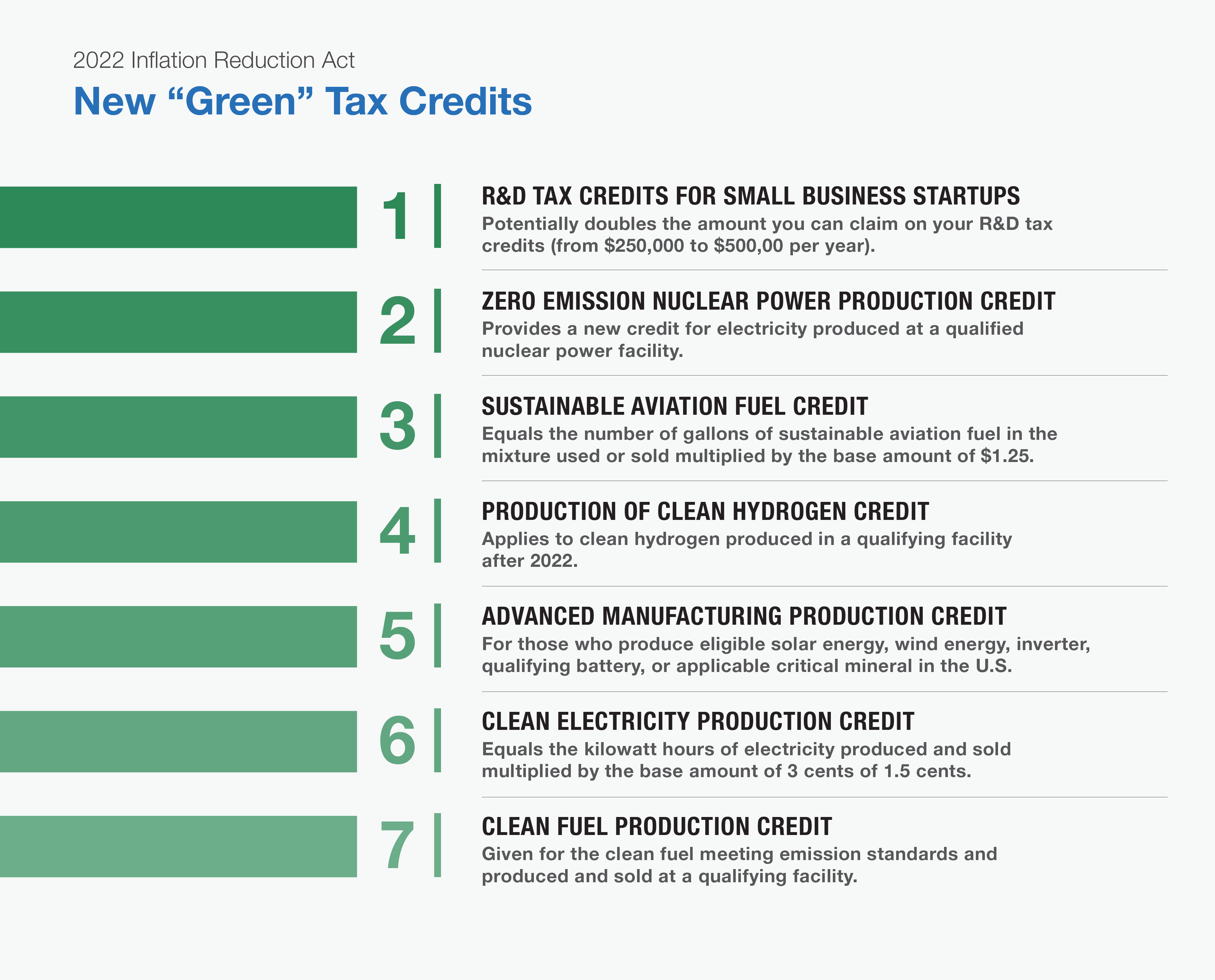

Source: blog.logcomex.com

Source: blog.logcomex.com

How Will The Inflation Reduction Act Impact Supply Chain?, [17] we report these studies’ original dollar figures, without applying any inflation adjustment. The tax year 2024 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from.

Source: www.mgocpa.com

Source: www.mgocpa.com

Guide to the “Green” Tax Credits and Incentives in the Inflation, [17] we report these studies’ original dollar figures, without applying any inflation adjustment. 1818 (2022)) greatly expanded federal income tax credits available to clean energy project.

Source: www.attainablehome.com

Source: www.attainablehome.com

Inflation Reduction Act Efficiency Tax Credits Total Guide, Total marketplace plan selections during 2024 open enrollment period. Get ready for inflation reduction act savings!

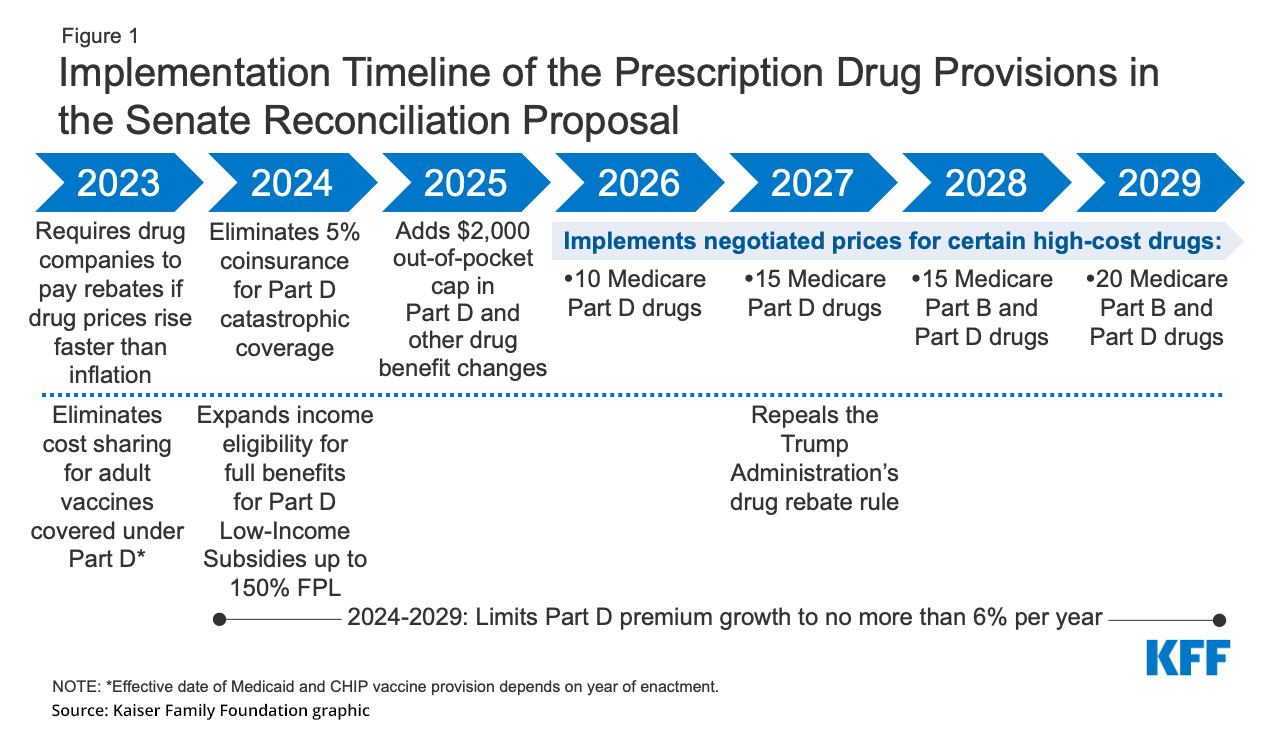

Source: www.thefulleragency.net

Source: www.thefulleragency.net

What the Inflation Reduction Act of 2022 Means for Medicare Fuller Agency, Last updated 22 march 2024. Learn which tax incentives and tax credits are changing or becoming available in 2024.

Source: www.catf.us

Source: www.catf.us

Summary of Tax Incentives in the Inflation Reduction Act of 2022, Learn which tax incentives and tax credits are changing or becoming available in 2024. The calculator says the smiths will qualify for rebates in 2024, and they qualify for $15,600 in available tax credits right away, which means they can claim.

Source: thegreenerelectron.com

Source: thegreenerelectron.com

How the 2023 Inflation Reduction Act EV Tax Credit Will Change for 2024, The calculator says the smiths will qualify for rebates in 2024, and they qualify for $15,600 in available tax credits right away, which means they can claim. The inflation reduction act is about more than just solar panels.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

What Is the Inflation Reduction Act and How Does It Affect M Ramsey, Credits and deductions under the inflation reduction act of 2022. Interactive guide to energy credits available under the inflation reduction act.

Source: www.ecicomfort.com

Source: www.ecicomfort.com

Inflation Reduction Act Summary & What it Means for New HVAC Systems, [17] we report these studies’ original dollar figures, without applying any inflation adjustment. A consumer guide to the inflation reduction act.

Here’s How To Save On Electric Vehicles, Solar Panels, Heat Pumps, And More Via Tax Credits And Rebates.

You may be able to.

The Calculator Says The Smiths Will Qualify For Rebates In 2024, And They Qualify For $15,600 In Available Tax Credits Right Away, Which Means They Can Claim.

On august 16, 2022, president biden signed the inflation reduction act (ira) into law, marking one of the largest investments in the.